This site has moved.

Please visit:

www.miamiopenforbusiness.org

Collective Real Estate Ownership (CREO)

The goal of the Collective Real Estate Ownership (CREO) funding opportunity is to facilitate the purchase and shared ownership of commercial real estate by historically underserved, minority-led nonprofits and small businesses by providing down payment and closing cost assistance.

Scroll to the bottom of this page to access the application link.

What can I apply for?

- Fully forgivable loans from $50,000 up to $500,000

- These funds can be used to cover down payment and select closing costs incurred at closing* for the purchase of a collectively-owned commercial real estate property. Click here for additional funding details.

- If awarded, the loan is forgiven over a 5 year period, provided conditions are met, such as not reselling the property

*Applicants pay for costs incurred prior to closing out of pocket, such as appraisal, inspection, environmental, and mortgage application fees

Am I eligible?

To apply, you must be:

- A collaborative of 2 or more small businesses and/or small nonprofits

- Owned or led by a person who is: Black, Latino, LGBTQ+, veteran, and/or disabled

- In operation for at least 2 years

- Based in and serving Miami-Dade County

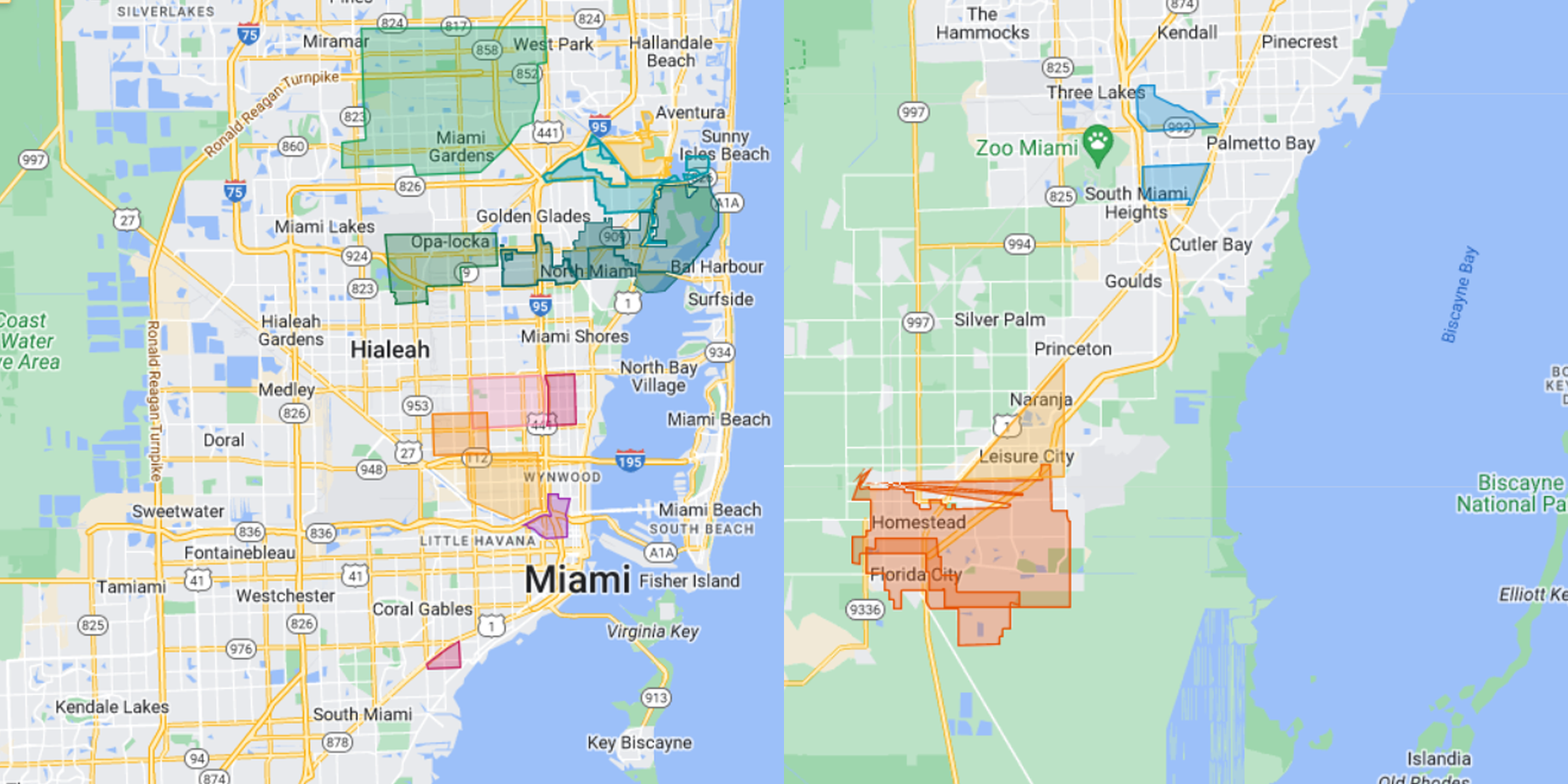

- Interested in a property located is in one of these communities

What do I need to apply?

- Complete an application to describe your organizations and your plans for the property.

- Strong applications have already identified a subject property and have a relationship with a realtor, mortgage lender, and attorney.

- Required attachments include:

- Project timeline and project budget

- Resume or bio for lead of each organization

- Lead applicant’s business or strategic plan

- Copy of financial statement* and/or operating budget for each organization

- Copy of cash flow projections* for lead organization

- Copy of mortgage preapproval and/or purchase agreement, if available

* Templates for financial statements and cash flow projections are provided, but not required to be used. Project budget template must be submitted.

What is the timeline?

- Applications are due by the 15th of every other month:

- April 15th, June 15th, August 15th

- Decisions will be shared by the end of the following month

- Example: Apply by 4/15/2023, notified by 5/31/2023

What if I need help with my application?

- Reach out to one of the organizations we have partnered with.

- Attend office hours with the application team.

How will decisions be made?

- Approximately 4-6 collectives will be funded this year.

- After each deadline, we review all applications using the same criteria below. Applications that score the highest will be funded.

- Proposal is feasible and aligns with program goals to support small businesses

- Owner(s) represent multiple aspects of historical disadvantage

- Collective ownership model is concrete and aligns with program goal of shared equity

- Financing plans and estimated payments are realistic and attainable

- Collaborative members have strong organizational and financial capacity

- Proposal will provide high-impact and create benefit for the community

North Dade

Miami Gardens

Opa Locka

North Miami

North Miami Beach

Central Dade

Allapattah

Brownsville

Liberty City

Little Haiti

Overtown

West Coconut Grove

South Dade

Homestead

Leisure City

Richmond Heights

Naranja

West Perrine