This site has moved.

Please visit:

www.miamiopenforbusiness.org

Financal Product Comparision

Below we provide a helpful overview and comparison of each of the product offerings.

What is it?

How much?

What can it be used for?

What do I need to apply?

What is the deadline?

If selected, when will I find out?

How many are selected annually?

Great! Where can I learn more?

Microgrant for Technology or Equipment

A grant, which does not have to be repaid.

Up to $20,000

Buy technology items, like laptops or cameras, OR buy equipment, like furniture, machinery, tools, etc.

• Specific vendor estimates

• Financial projections (business)

• Annual operating budget (nonprofit)

• Staffing roster

May 31, 2023

July 2023

50-60 organizations

Asset Building Loan for Entrepreneurs (ABLE)

A loan, which is repaid over time.

Between $1,000 – $100,000

Finance the purchase of a commercial vehicle, bulk inventory (to resell), renovations to your business, refinance predatory debt used to buy assets, and more.

• Specific vendor estimates

• Financial projections

• Financial statements, tax returns (business & personal)

• Staffing roster

December 1, 2023

5-10 business days after submitting complete package

30-50 organizations

Collective Real Estate Ownership (CREO)

A forgivable loan, which is forgiven over time and not repaid if certain conditions are met.

Between $50,000 – $500,000

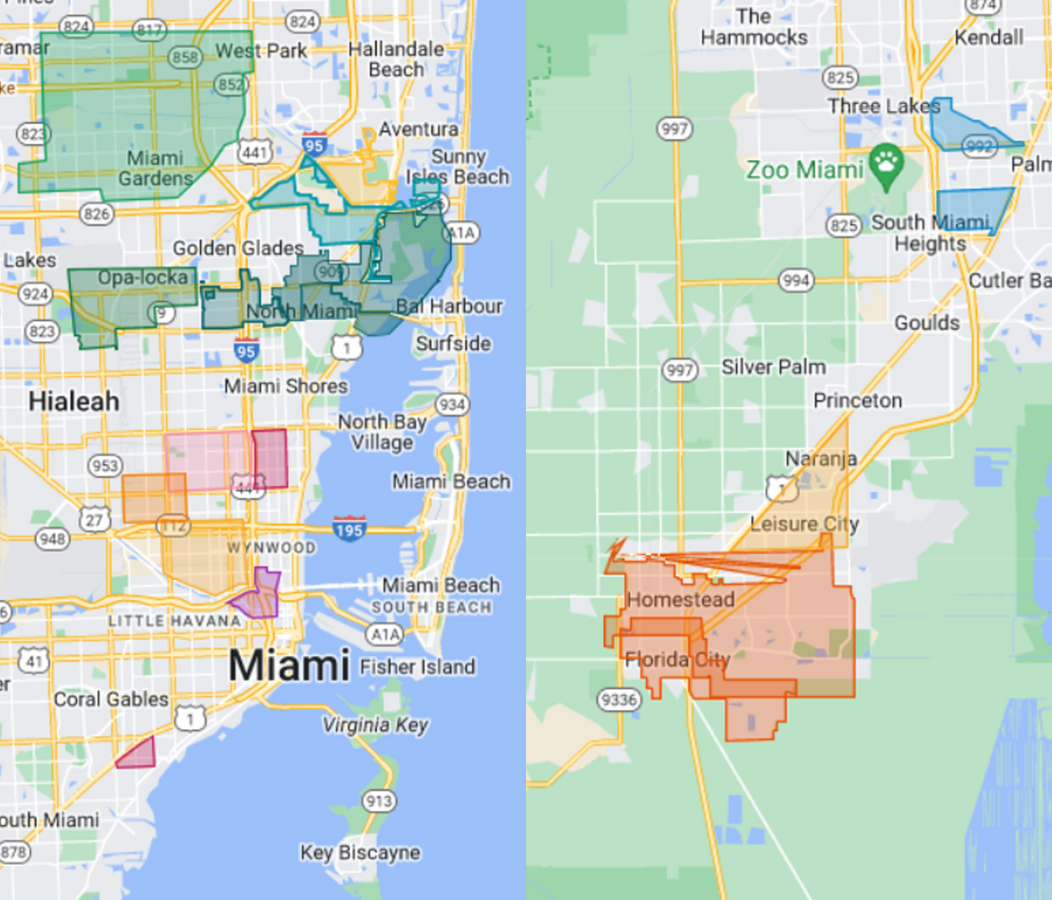

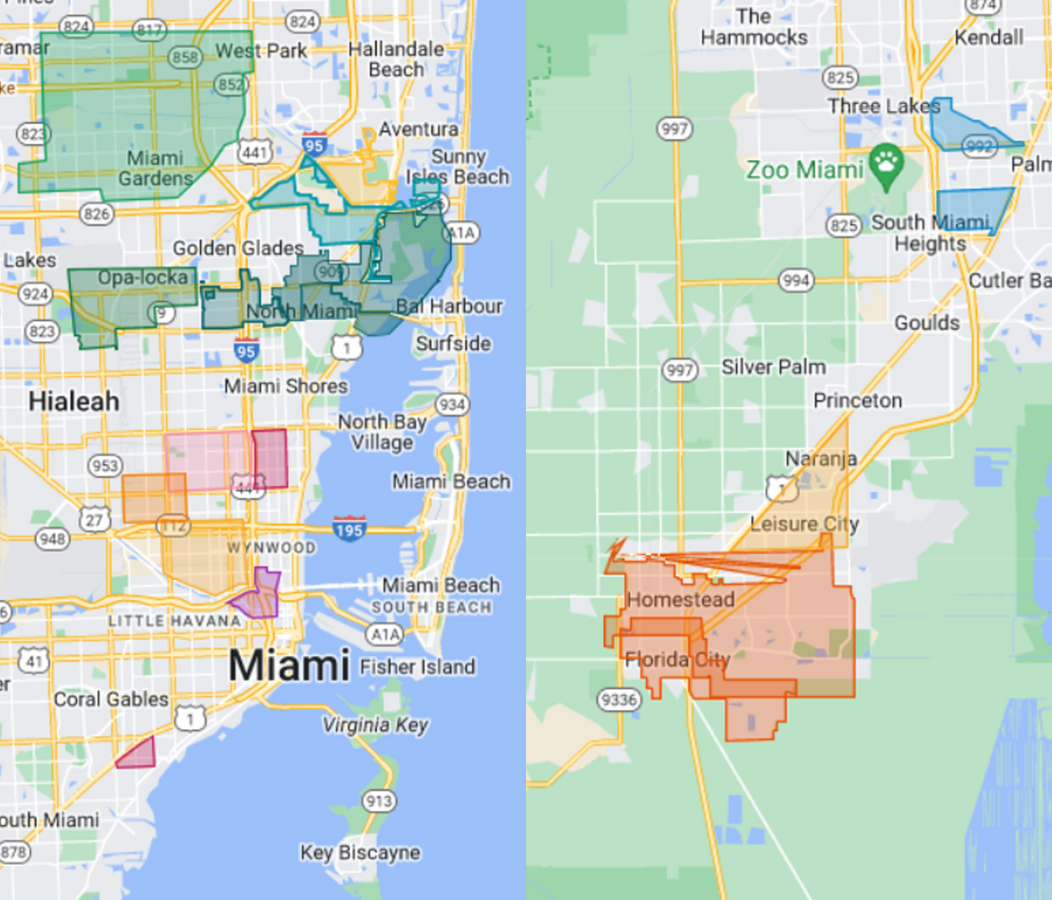

Cover the down payment and closing costs to purchase a commercial property in certain Miami-Dade communities

• A collaborative of at least 2 or more companies

• Project budget & timeline

• Financial projections, financial statements, operating budget

• Business plan

April 15, 2023,

June 15, 2023, or

August 15, 2023

By the end of the month after you apply (e.g., 4/15 → 5/31)

4-6 collaboratives

- Microgrant for Technology or Equipment

- Asset Building Loan for Entrepreneurs (ABLE)

- Collective Real Estate Ownership (CREO)

Microgrant for Technology or Equipment

What is it?

A grant, which does not have to be repaid.

How much?

Up to $20,000

What can it be used for?

Buy technology items, like laptops or cameras, OR buy equipment, like furniture, machinery, tools, etc.

What do I need to apply?

• Specific vendor estimates

• Financial projections (business)

• Annual operating budget (nonprofit)

• Staffing roster

What is the deadline?

May 31, 2023

If selected, when will I find out?

July 2023

How many are selected annually?

50-60 organizations

Great! Where can I learn more?

Asset Building Loan for Entrepreneurs (ABLE)

What is it?

A loan, which is repaid over time.

How much?

Between $1,000 – $100,000

What can it be used for?

Finance the purchase of a commercial vehicle, bulk inventory (to resell), renovations to your business, refinance predatory debt used to buy assets, and more.

What do I need to apply?

• Specific vendor estimates

• Financial projections

• Financial statements, tax returns (business & personal)

• Staffing roster

What is the deadline?

December 1, 2023

If selected, when will I find out?

5-10 business days after submitting complete package

How many are selected annually?

30-50 organizations

Great! Where can I learn more?

Collective Real Estate Ownership (CREO)

What is it?

A forgivable loan, which is forgiven over time and not repaid if certain conditions are met.

How much?

Between $50,000 – $500,000

What can it be used for?

Cover the down payment and closing costs to purchase a commercial property in certain Miami-Dade communities

What do I need to apply?

• A collaborative of at least 2 or more companies

• Project budget & timeline

• Financial projections, financial statements, operating budget

• Business plan

What is the deadline?

April 15, 2023,

June 15, 2023, or

August 15, 2023

If selected, when will I find out?

By the end of the month after you apply (e.g., 4/15 → 5/31)

How many are selected annually?

4-6 collaboratives

Great! Where can I learn more?

Need help with your application? Work with one of our providers.